I’m continuing to learn more about GnuCash in order to use it more effectively.

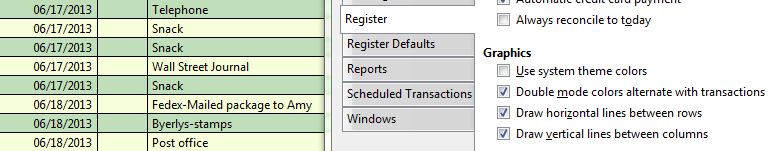

Make the display a little less cluttered by removing the horizontal and vertical lines from the register view. Edit -> Preferences dialog, then the Register tab. Note the two checkboxes, Draw horizontal lines between rows, and Draw vertical lines between columns. Before:

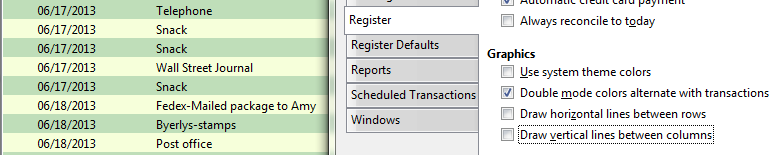

After:

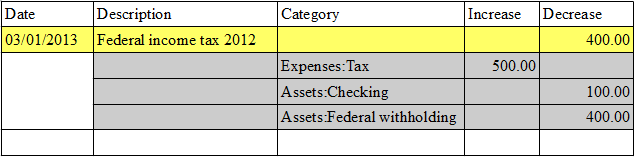

Transaction filtering

I’ve found this to be helpful when looking at a reimbursements account. I mark a reimbursement as cleared once I’ve received the money back from the company. Sometimes the reimbursements get cleared out of order because I have submitted them out of order. Then, when I submit my next reimbursement, I use transaction filtering to narrow down the display to just the un-submitted reimbursements.

How to filter transactions: View -> Filter By… Click the Status tab.

My beef with the summary bar

The summary bar appears above the status bar and includes information pertaining to the currently opened tab. On the main accounts page, it shows the grand total of all assets as well as the profit. The profit is calculated by subtracting YTD expenses from YTD income. Therefore, it gives a rough idea of how much money I’ve saved so far this year. However, I find this idea a bit misleading.

For example, it is August 2013. Lets say I will save $100 a month this year, by spending less than I earn each month. This is a monthly profit of $100, so at the end of the year, my profit would show $1200. However, let’s say that since April of 2009, I’ve been saving up to buy a car, and it will cost $5000. At the beginning of 2013, I had $4200 in my accumulation, and now in August, my accumulation fund has reached maturity. I buy the car for $5000. Suddenly the summary bar reports a profit of $-4200, whereas before it said $800. This is a little disconcerting.

In summary (pun intended) the summary bar’s profit calculation is not helpful for personal finance since it doesn’t help you know if you’ve stayed on budget. However, for other Tabs or Pages, such as stock accounts, the summary bar provides useful information, such as the current value of the shares held. So I wish there was an option to disable the profit calculation from showing, but keep the other useful information visible.